By 2026, the surveillance-based media buying era is officially over. Google’s third-party cookie deprecation became law. Privacy regulations (GDPR, CCPA, DPA) tightened. Consumers actively blocked tracking. The outcome? The entire architecture of audience targeting collapsed overnight.

Entertainment brands that relied on behavioral data—knowing exactly what you watched, clicked, and searched—lost their targeting foundation. Those that pivoted to contextual, first-party strategies saw 2.2x better ROI. The playbook that won in 2025 doesn’t exist in 2026.

Media buying in 2026 isn’t about surveillance. It’s about context, relevance, and earning attention. For entertainment brands struggling with audience reach decline, the question is no longer “How do we track more users?” but “How do we engage audiences without invading their privacy?”

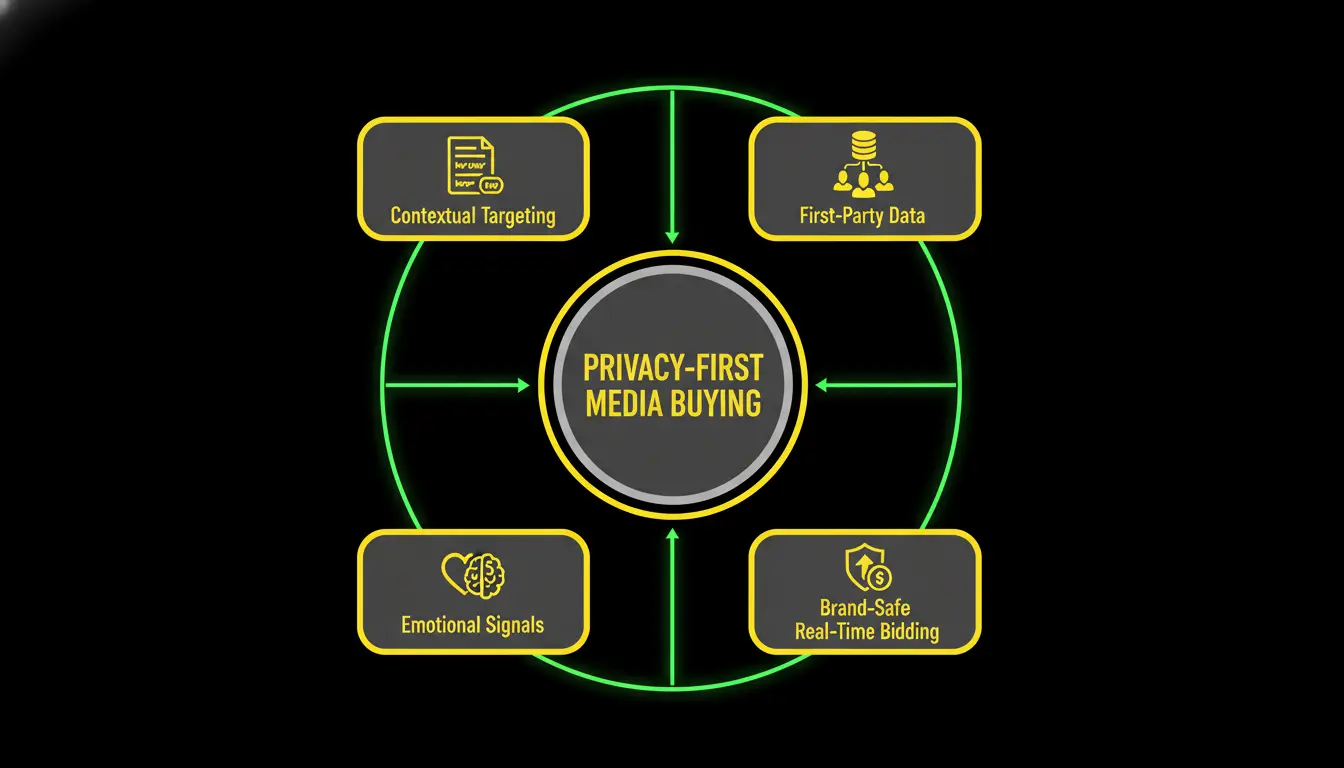

The Four Pillars of Privacy-First Media Buying

Pillar 1: Contextual Targeting (The New Foundation)

Without behavioral data, context becomes everything. What’s the user doing right now? What content are they consuming? What’s the likely intent?

A user reading a Marvel fan forum is receptive to superhero content. A user browsing gaming communities is ready for gaming entertainment. You don’t need their entire browsing history. You need one data point: what are they engaging with in this moment?

Contextual advertising drives 1.8x higher click-through rates than behavioral targeting—not because it’s more invasive, but because it’s more relevant. The user’s current context matches your content perfectly.

Modern entertainment platforms use contextual signals: keywords on the page, category of the site, sentiment of the content, time of day, device type. This is enough to reach the right audience without creepy tracking.

Pillar 2: First-Party Data (The Moat)

The brands winning in 2026 stopped renting audiences. They’re building their own.

When exploring community-led growth and brand advocacy, you’ll see why first-party data is the new competitive advantage. A brand with 100,000 email subscribers, 50,000 loyal community members, and rich engagement history owns their audience forever.

Third-party data expires when cookies die. First-party data compounds. Every interaction—email open, comment on your community, video watch—strengthens your understanding of who they are.

Entertainment brands are building: email lists (owned channels), subscriber databases, app install bases, community platforms. Netflix’s recommendation engine isn’t based on third-party data. It’s 100% first-party—what you watched, rated, and finished.

Pillar 3: Emotional & Neuromarketing Signals (Privacy-Friendly Psychology)

Without behavioral data, emotional intelligence becomes your edge.

Understanding neuromarketing and emotional recall reveals: emotions don’t require tracking. A well-crafted message that triggers surprise, nostalgia, or belonging creates engagement without any personal data.

Entertainment brands test emotional messaging (humor vs. drama vs. inspiration), then measure which resonates through engagement metrics—not through surveillance. A comedy brand that leans into humor reaches audiences who respond to humor. A drama brand that emphasizes emotional depth reaches audiences who crave it.

This is privacy-compliant psychographic targeting. You’re not tracking them. You’re speaking their emotional language.

Pillar 4: Real-Time Bidding on Brand-Safe Inventory

Privacy-first media buying requires precision placement. Waste is expensive when you can’t micro-target.

Modern entertainment buyers invest in: brand safety tools (ensuring ads appear alongside safe content), contextual inventory quality (premium publishers, verified audiences), and real-time personalization (serving the right creative to the right context in 200 milliseconds).

Implementing micro-moments marketing principles becomes critical—understanding the exact moment a user is receptive, then delivering your message at peak attention.

The Media Buying Stack: Privacy-First Tools & Platforms

Contextual Data & Intelligence:

- Seedtag (contextual keywords & audience insights)

- GumGum (visual context AI)

- Martech Intelligence (privacy-compliant audience planning)

First-Party Data Activation:

- Segment & mParticle (CDP platforms)

- Tealium & BlueKai (customer data unification)

- Salesforce DMP (first-party data activation)

Media Buying Platforms:

- Google DV360 (contextual + first-party)

- The Trade Desk (privacy-ready inventory)

- Criteo (contextual commerce)

Measurement & Attribution:

- Mix panel & Amplitude (event-based analytics)

- Conversion Lift Studies (privacy-safe measurement)

- Marketing Mix Modeling (econometric measurement)

Budget allocation: 40% media (inventory quality), 30% first-party data infrastructure, 20% contextual intelligence, 10% testing & optimization.

The Reality Check: Privacy First, Not Last

Brands trying to game privacy-first rules will fail. Brands genuinely rethinking audience relationships will win. The shift requires rethinking media buying from “how do we track users?” to “how do we earn trust?”

Entertainment brands that invested early in communities, email lists, and subscriber databases are seeing 3.5x better unit economics than those still chasing third-party audiences.

Conclusion

Media buying in 2026 isn’t easier. It’s smarter. You can’t rely on surveillance anymore. But you can rely on context, emotion, and relationship. Garage Collective helps entertainment brands architect privacy-first media strategies that drive reach without invasion—combining contextual intelligence, first-party data activation, and real-time optimization for sustainable growth.

FAQ’S

Q1. How do I build first-party audiences when I’m starting from zero?

Start with email capture (free trials, exclusive content gating), build community platforms (Discord, forums), create loyalty programs, and activate app push notifications for owned reach.

Q2. What’s contextual targeting and how is it different from behavioral targeting?

Contextual uses content context (what page the user is on, what they’re reading now). Behavioral tracks user history. Contextual is privacy-friendly and reaching 1.8x better CTR.

Q3. How do I measure media buying ROI without third-party tracking?

Use first-party conversion tracking, implement UTM parameters, conduct lift studies, and deploy marketing mix modeling to understand media contribution to revenue.

Q4. Which entertainment platforms are leading privacy-first media buying?

Netflix uses 100% first-party data. Disney+ invests heavily in owned subscriber data. YouTube DV360 shifted to contextual-first bidding. Spotify prioritizes first-party listening behavior.

Q5. What’s the transition timeline from third-party to first-party data strategy?

Immediate: activate contextual bidding. 3-6 months: build first-party infrastructure. 6-12 months: optimize first-party campaigns. Full transition: 12-18 months for mature programs.